The Spanish Parliament has given the green light to a new startups law which will bring tax benefits and other perks to entrepreneurs, remote workers and digital nomads who want to live and work in Spain.

It’s been in the pipeline for 16 months, but on 3 November 2022 evening Spain’s Parliament finally approved its highly anticipated startups law, or Ley de Startups.

The legislation had already been greenlighted by Spain’s Commission for Economic Affairs and Digital Transformation, which made 271 amendments to the initial draft bill, as well as the Spanish Council of Ministers.

Its approval in the Spanish Parliament is a crucial step for the law to come into force, which is expected to be in January 2023, once the Senate has processed its parliamentary implementation.

The law was given the thumbs up in the Spanish parliament by 177 MPs, with 75 abstentions (by far-right party Vox and Catalan parties Junts and ERC) and 88 votes against (mostly from MPs belonging the right-wing PP who called for the law to be more far reaching).

This majority is expected to guarantee the legislation is ratified without trouble in the Senate in the coming weeks.

“It’s one of the most enjoyable moments I’ve experienced in the Parliament,” joked Economic Affairs Minister Nadia Calviño about the support the “pioneering” legislation has received from across the country’s political spectrum.

“It’s a law that will allow Spain to be at the forefront in the push and promotion of talent in this rapidly growing digital economy”.

Spain already attracts many foreigners from around the world thanks to its great climate and famed quality of life, but up until now it hasn’t been legally possible for many remote workers or digital nomads to work here without the correct visa or complex paperwork.

In 2015, Spain ranked among the worst OECD countries to start a business in, so the hopes are that the new law will change this reputation.

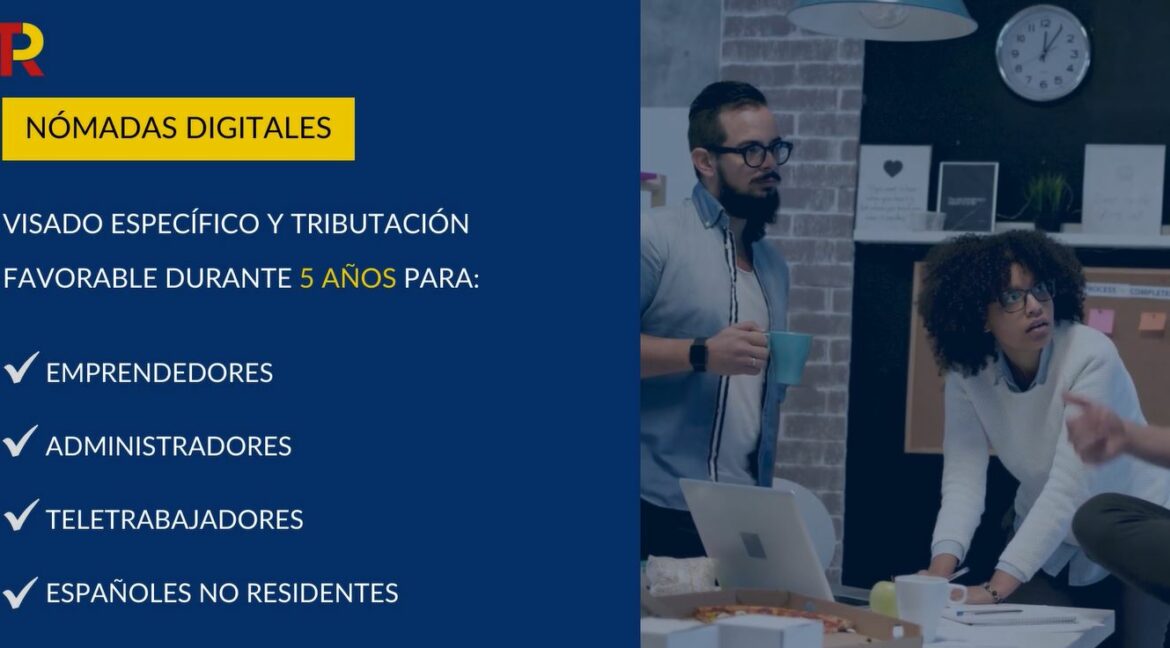

The startups law will be open to anyone from the EU or third countries, as long as they haven’t been a resident in Spain in the previous five years, and it will allow workers to gain access to a special visa which can be renewed for up to five years.

It will give startups and investors a reduction in Corporation Tax from 25 to 15 percent during the first four years and will also allow digital nomads and other remote workers to pay Non-Residents Tax (IRNR) than the regular income tax Spanish residents pay (IRPF), and at a reduced rate of 15 percent rather than 25 percent.

How long will digital nomads be allowed to stay in Spain?

The law also includes a new visa that will allow digital nomads to stay and work in Spain for a period of one year. Once it has expired, they will be able to extend it by requesting a residence authorisation as a remote worker for a further two years and then extend it again, up to five years.

What hasn’t been confirmed yet are the exact conditions and requirements digital nomads will have to meet, such as the minimum amount they’ll have to earn or the type of qualifications they might have to have.

Who will be able to apply for Spain’s digital nomad visa?

Applicants will need to be from outside of the European Economic Area. They will also need to be able to demonstrate that they have been working remotely for at least a year and have a contract of employment or, if freelancing, have been regularly employed by a company outside of Spain.

Anyone wanting to take advantage of the digital nomad scheme will have to prove that they earn enough money to be self-sufficient – likely to be around €2,000 a month.

Applicants will need an address inside of the country and be able to submit documentation like a rental contract to prove this.

It’s also not clear yet whether digital nomads will have to pay social security and be eligible for state health care or if they’ll have to get private health insurance to meet the requirements for the visa.

Courtesy of thelocal.es